Highlights

- Crypto analyst Michael van de Poppe calls it a temporary shakeout in altcoin market.

- Van de Poppe highlights several factors that could drive an altcoin resurgence, including macroeconomic shifts.

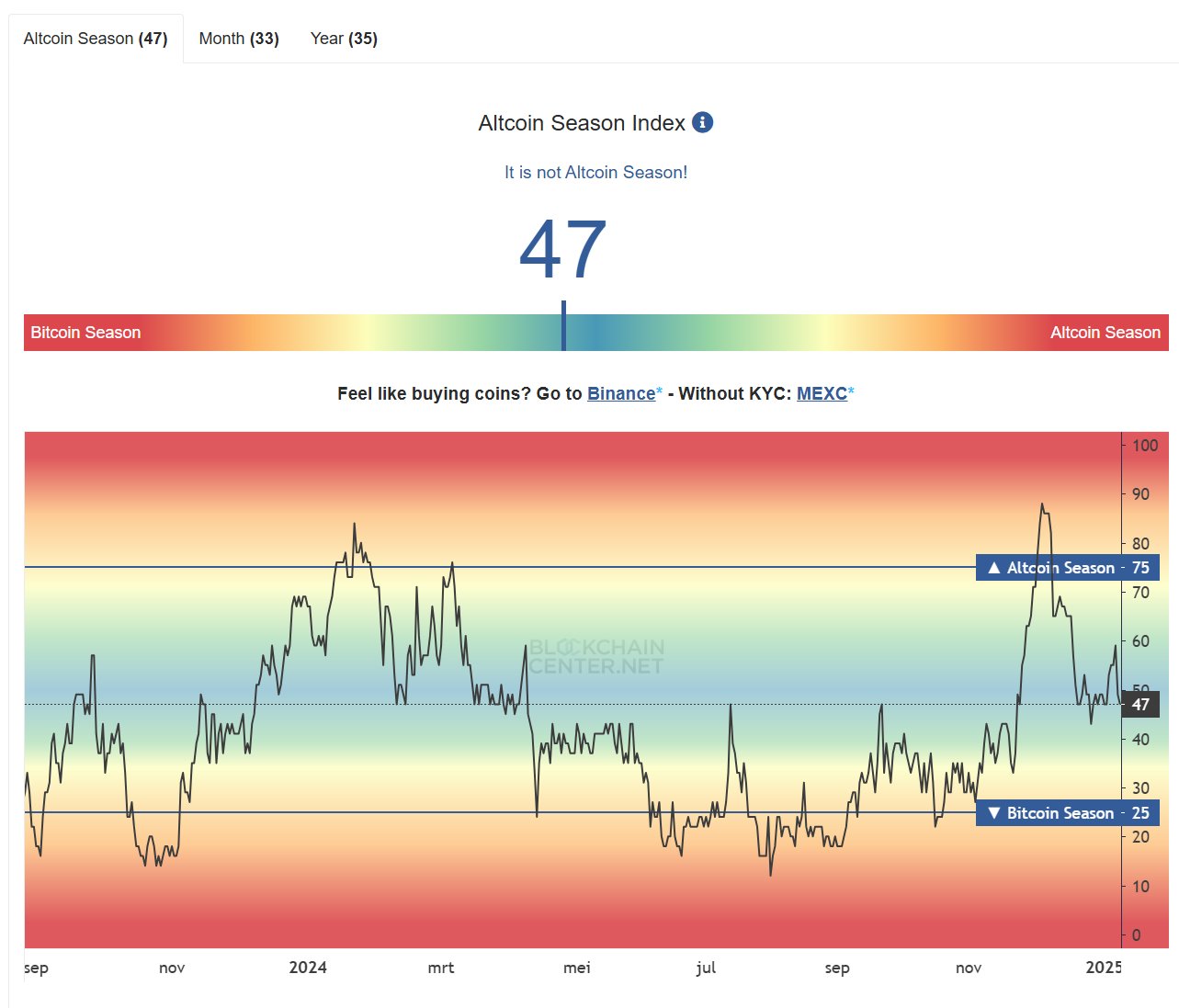

- The Altseason Indicator has dropped below the 50 mark, signaling an accumulation opportunity for investors.

With Bitcoin and the overall crypto market facing a major correction, investors question whether this is the end of the altcoins bull market. However, popular analyst Michael van de Poppe believes that the bull market is very much intact and the current phase is just the final shakeout before a mega rally ahead.

Altcoins Market Rally to Continue Per Historical Trends

Calling it a temporary shakeout in the altcoins market, popular crypto analyst Michael van de Poppe draws comparisons with the historical patterns from the past bull runs in 2017 and 2021 and the overall outperformance in that bullish cycle.

Similarly, while Bitcoin has dominated market trends in 2023 and 2024, with a meteoric rise from $17,000 in late 2022 to $93,000 today, altcoins are poised for a resurgence. Michael van de Poppe explained that recent setbacks, including fears surrounding USDT Tether, rising yields, and a strong U.S. dollar, have dampened market sentiment.

However, political and economic developments, such as President-elect Donald Trump’s pledge to lower interest rates, signal a potential shift. Trump’s policies aim to address high debt payments and a strong dollar, mirroring his approach in 2016, which subsequently boosted markets following a massive expansion of global M2 money supply.

Key Factors to Watch Ahead

In his message on the X platform, Michael van de Poppe shares some of the key macro indicators and other factors to watch ahead for big opportunities in the altcoins market. Below are the three key factors to watch for:

- Macroeconomic Shifts: Inflation, slowing GDP, and weakening labor markets are signs of economic softness. If these trends result in lower yields and quantitative easing (QE), cryptocurrencies stand to benefit.

- Political Influence: Trump’s potential economic policies, including reduced interest rates and a weaker dollar, could catalyze a bullish crypto cycle.

- Altcoin Valuations: Many altcoins are at cycle lows against Bitcoin, historically a signal for future market rallies.

Altseason Index Drops Under Crucial Support

Following the recent crypto market correction, the altseason indicator has dropped under crucial support levels indicating that the market is not in an altseason. However, with the indicator dropping below the 50 mark, it presents a promising opportunity for investors to accumulate altcoins, noted Michael van de Poppe, citing Blockchain Center data.

He predicts that crypto will thrive under a crypto-friendly Trump administration, particularly as QE policies gain traction. As meetings between Trump and crypto leaders make headlines, investors are urged to remain patient. Current market conditions, while challenging, are not indicative of a bear market.

With altcoins at low valuations and Bitcoin yet to enter a euphoria phase, the crypto market is poised at the cusp of a potentially massive 4-year cycle. Also, the announcement of a US Bitcoin reserve in Q1 could be a game-changer for the overall crypto space.

- Analyst Predicts 200% Surge For FLOKI Price But This Must Happen First

- Bitget Token Price Jumps 12% Defying Market Trend, Can BGB Rally Continue?

- Why Shiba Inu And Dogecoin Meme Coins May Crash Ahead?

- Shiba Inu Community Burns 87M Coins This Week, What’s Next For SHIB?

- Crypto Trader Turns $458K Into $4.9M With This Meme Coin In 2 Weeks, Here’s All

- Top 3 Reasons to be Bullish on Dogecoin (DOGE) Price

- 3 Solana Rivals to Turn $10K into $100K in January 2025

- Ripple (XRP) Price Analysis: XRP traders deposit $85M on Binance as market sell-off cools

- Solana (SOL) Price Analysis: Staking Inflows Fuel Rebound Hopes, Can SOL Reclaim $250?

- Could Pepe Coin Price See an Explosive 8X Surge Soon?

VIP Casino

VIP Casino