Highlights

- Ethereum price fell 9% as it leads $700 million in total crypto liquidation.

- Whales and institutions sell ETH and Ethereum Foundation makes fell ETH sale of 2025.

- Spot Ethereum ETFs recorded net outflow and price shows not signs of recovery.

The second-largest crypto Ethereum saw a sharp selloff of more than 9% in the last 24 hours. ETH price tumbled to mid-November levels of $3,300 as traders took cues from robust US macroeconomic data, which shot down the Fed rate cut hopes.

Ethereum Price Led $700 Million in Net Crypto Liquidation

The broader crypto market and Bitcoin price saw major selloff, but ETH led the liquidation in the last 24 hours. Coinglass data reveals more than $152 million in ETH were liquidated, with $132 million in long positions. Whereas, BTC saw $128 million in liquidation.

The total crypto liquidation reaches $710 million in the last 24 hours. Notably, 237,476 traders were liquidated and the largest liquidation happened on leading crypto exchange Binance as someone sold ETH valued at $17.74 million. This is one of the largest in Ethereum history.

Whales and Institutions Offload ETH Holdings

Multiple ETH sell transactions were recorded over the last 24 hours as whales and institutional investors pared their holdings. Ethereum price fell after investors lost confidence about further rally as JOLTS job openings and ISM Services PMI data showed a strong US economy. This will cause the U.S. Federal Reserve to delay its rate cuts this year.

Whale Alert highlighted a 40,000 ETH transfer worth $140.44 million from Arbitrum to Binance. In addition, 18,172 ETH valued at $66 million transferred from Cumberland to Coinbase Institutional.

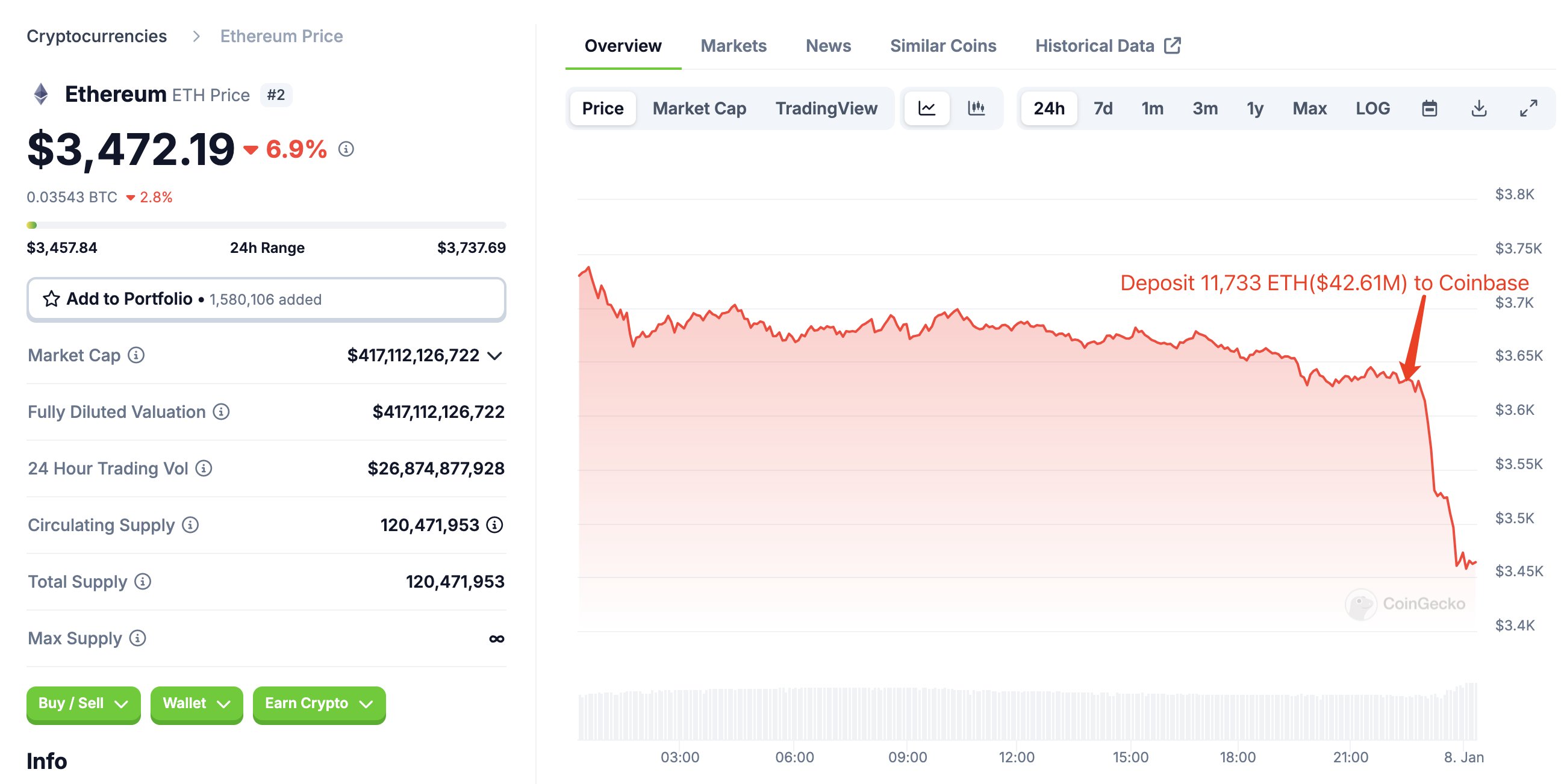

WisdomTree also deposited 11,733 ETH to Coinbase just before the crypto market crashed, reported Lookonchain.

Ethereum Foundation Makes First ETH Sale of 2025

The Ethereum Foundation just made its first ETH sale of the year. The foundation has transferred 100 ETH, valued at $336K, for 329,463 DAI. The foundation has sold nearly $12.96 million in ETH in 2024, which has limited the upside trajectory for Ethereum price.

Spot Ethereum ETFs Record Outflow

As institutional investors lost confidence, spot Ethereum ETFs saw a net outflow of $86.8 million on Tuesday. Farside Investors data shows outflows mainly came from Fidelity’s FETH, Grayscale’s ETHE and ETH mini exchange-traded fund. The ETF flow is considered an indicator of strength in an asset and investors keep an eye on it to know the current sentiment.

What’s Next for Ethereum Price

Ethereum price currently trades at $3,329 and there are no signs of recovery yet. Experts have given $5000 and $10000 price targets for this year.

ETH derivatives data shows that open interest has dropped 7%. ETH Futures OI 9.04 million are now valued at $30.33 billion. Whereas, Options OI has increased as traders rearrange calls and puts.

Analyst IncomeSharks revealed quick scalp trade on the lower time frame. He suggests looking for a bounce and then closing long. Meanwhile, another analyst Crypto Tony said “As long as we hold $3200 on the daily closure I remain in my long.”

- Analyst Predicts 200% Surge For FLOKI Price But This Must Happen First

- Bitget Token Price Jumps 12% Defying Market Trend, Can BGB Rally Continue?

- Why Shiba Inu And Dogecoin Meme Coins May Crash Ahead?

- Shiba Inu Community Burns 87M Coins This Week, What’s Next For SHIB?

- Crypto Trader Turns $458K Into $4.9M With This Meme Coin In 2 Weeks, Here’s All

- 3 Solana Rivals to Turn $10K into $100K in January 2025

- Ripple (XRP) Price Analysis: XRP traders deposit $85M on Binance as market sell-off cools

- Solana (SOL) Price Analysis: Staking Inflows Fuel Rebound Hopes, Can SOL Reclaim $250?

- Could Pepe Coin Price See an Explosive 8X Surge Soon?

- Shiba Inu (SHIB) Price Analysis: Whales Scoop 34 trillion SHIB, Time to Abandon DOGE?

VIP Casino

VIP Casino