Highlights

- Bitcoin has outperformed Google, Microsoft, Amazon, Apple, and Meta over the past year.

- Tight global macro conditions would continue to weigh on Bitcoin volatility with further room for downside.

- Bitcoin has a month of consolidation ahead of us before beginning the bull rally.

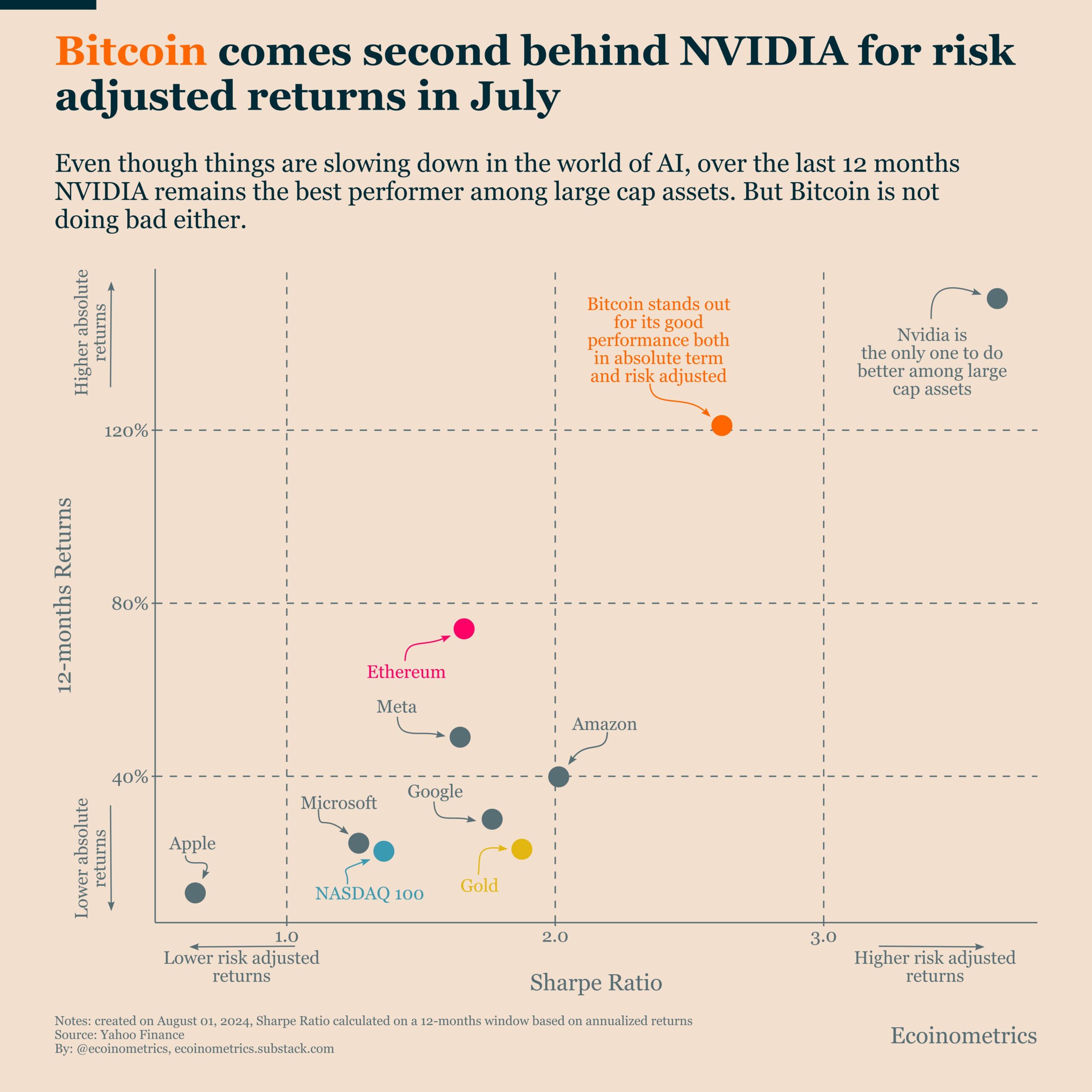

Despite the strong volatility seen in the Bitcoin price throughout July, the asset class has outperformed some of the big tech giants like Google, Microsoft, Apple, Meta, and Amazon, on a 12-month risk-adjusted basis. Only Nvidia (NASDAQ: NVDA) has managed to pull off a better performance than BTC amid the solid boom for artificial intelligence over the last year.

Nvidia Beats Bitcoin

Despite the strong tech market rally over the last year, most of the big tech giants have fallen way behind Bitcoin percentage returns on a 12-month chart. As per the below chart, only Nvidia has managed to beat Bitcoin with 140% gains on the yearly chart while BTC stands at 120% gains as of the current Bitcoin price of $61,500.

As shown in the below image, most of the big tech giants have given less than 40% returns in the same time period while the gold returns are somewhere around 20%, per the data presented by ecoinometrics.

However, it’s the macro conditions currently driving the fluctuations in the Bitcoin price. Over the last week, both Bitcoin and Nvidia have corrected 6-7% in the recent market rout.

On the other hand, the global economy is in a tight position with the US unemployment data coming higher than expected flashing major signals of a US recession going ahead. Ecoinometrics noted:

“If that’s where we are heading Bitcoin will have a bad time like every other risk asset. It is only on the other side, when monetary liquidity makes a comeback that it will outperform again. So it’s important to watch closely where the US economy is going in the short term”.

On the other hand, with the Bank of Japan increasing interest rates and Yen strengthening, tech firms on Wall Street could face similar volatility going ahead.

Also Read: Ethereum Going to $2K Says Peter Schiff, Altcoins Bleed Amid US Recession Fears

BTC At Crucial Support

Bitcoin is facing strong selling pressure and currently trading at a crucial support with a scope for an additional downside, reported Rekt Capital. Currently, BTC has completed 110 days past the halving event. Historically, BTC has always given a breakout 150-160 days post the Halving event. Thus, we have a month of consolidation ahead of us before we see the actual surge going ahead.

Bitcoin has returned to the Range Low area, with scope still for additional downside deviation in the near future

And currently at ~110 days after the Halving, Bitcoin is slowly getting closer to its historical breakout point of 150-160 days after the Halving$BTC… https://t.co/k2oqjOD85D pic.twitter.com/Ox1SXLXptu

— Rekt Capital (@rektcapital) August 3, 2024

Also Read: Senator Cynthia Lummis Bitcoin Bill Bags 2200 Co-Sponsor Requests

- Analyst Predicts 200% Surge For FLOKI Price But This Must Happen First

- Bitget Token Price Jumps 12% Defying Market Trend, Can BGB Rally Continue?

- Why Shiba Inu And Dogecoin Meme Coins May Crash Ahead?

- Shiba Inu Community Burns 87M Coins This Week, What’s Next For SHIB?

- Crypto Trader Turns $458K Into $4.9M With This Meme Coin In 2 Weeks, Here’s All

- Top 3 Reasons to be Bullish on Dogecoin (DOGE) Price

- 3 Solana Rivals to Turn $10K into $100K in January 2025

- Ripple (XRP) Price Analysis: XRP traders deposit $85M on Binance as market sell-off cools

- Solana (SOL) Price Analysis: Staking Inflows Fuel Rebound Hopes, Can SOL Reclaim $250?

- Is Pepe Coin Price Set for a Massive 8X Price Gain?

VIP Casino

VIP Casino